An Unbiased View of What Is Trade Credit Insurance

Table of ContentsThe Ultimate Guide To What Is Trade Credit Insurance9 Easy Facts About What Is Trade Credit Insurance ShownNot known Facts About What Is Trade Credit InsuranceThe 5-Second Trick For What Is Trade Credit Insurance

This is supplied by some profession finance experts covering the potential hold-ups to repayment which might originate from money transfer restrictions, or the insolvency of a government customer. Our political risk insurance coverage assists businesses to safeguard their overseas investments in situations such as political physical violence or confiscation of possessions, or various other threats referring to the activities of a foreign federal government.In some cases it does work out much greater than this if there is incomplete credit score history or other red flags. As with any kind of type of insurance coverage, there is a computation to be done around danger.

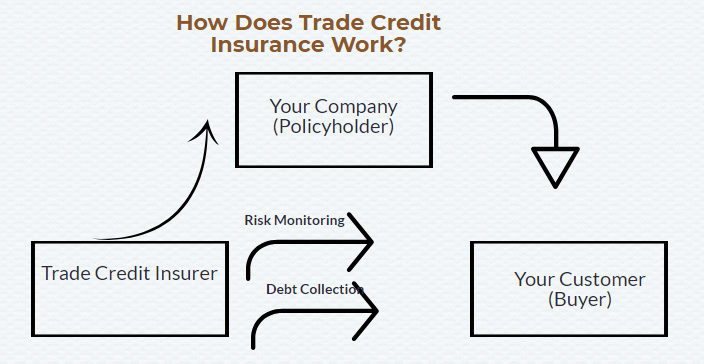

They allot each of those customers a grade that shows the wellness of their activity as well as the method they perform business. Based upon this threat assessment, each of your customers is then approved a particular debt limitation approximately which you, the guaranteed, can trade and be able to insurance claim should something fail.

What Is Trade Credit Insurance Fundamentals Explained

The warranties will cover trading by domestic companies and exporting companies as well as the intent is for arrangements to be in position with insurance providers by end of this month. The guarantee will certainly be temporary and targeted to cover Covid-19 economic obstacles, and it will be complied with by an evaluation of the TCI market to ensure it can best support businesses in future.

It is essential to obtain the information right so that the system helps organizations as well as insurers, and likewise provides value for cash for the taxpayer. It is crucial that insurance providers can keep their underwriting requirements as well as risk management methods, to ensure that support is provided to businesses that can trade out of the existing situation - What is trade credit insurance.

Offered the sudden disturbance to economic task, as well as the increased dangers of insolvency and default on the market, profession credit scores insurance providers might immediately withdraw several of the insurance coverage that they currently offer in order to stay viable. The option would be to increase costs somewhat that is uneconomical for all events.

Trade credit insurance policy plays an especially significant role in non-service markets, such as manufacturing and building, providing businesses the self-confidence to patronize one an additional. The Government is keen to make certain that these sectors are not place into further distress as an outcome of the Covid-19 dilemma. This scheme will make sure that supply chains remain to be protected from the potential domino impact of trade interruption and also organization defaults.

How What Is Trade Credit Insurance can Save You Time, Stress, and Money.

The details are still being settled by the UK Federal government as well as being gone over with insurance providers. The federal government is functioning with industry to settle the details of the scheme.

The Federal government's top priority for this plan is to function with insurance firms to support UK businesses. It is the Federal government's intention that this system will permit the trade credit rating market to run as normal, as much as possible.

Rumored Buzz on What Is Trade Credit Insurance

More details of the scheme will be announced eventually. The Federal government's concern for this system is to support UK organizations that might be impacted by the withdrawal of trade credit insurance policy cover throughout the Covid-19 dilemma. page In the longer term, it will certainly be appropriate to review the efficiency of this treatment, assess exactly how the marketplace replied to financial disruption, and also think about exactly how it can remain to finest serve services.

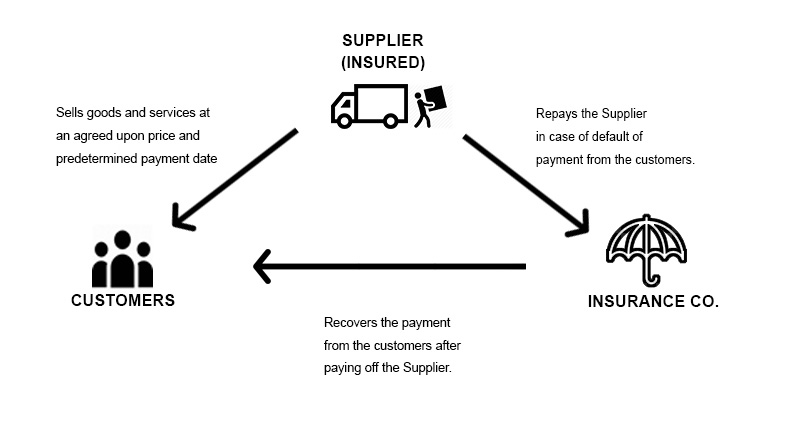

While the biggest operators out there are abroad firms, this is not a bailout for insurance firms. We are dealing with the insurers to ideal support British businesses. Trade credit insurance policy offers protection for businesses when clients do not pay their financial obligations owed for product and services. The plan will certainly reimburse the policyholder in the event of the purchaser's non-payment, up to a certain credit scores limit established by the insurance firm.

This could aggravate the financial influences of the pandemic by triggering concerns for liquidity and working capital for customers and harmful trust fund in supply chains.

The sales of goods and also solutions are exposed to a substantial variety of risks, a number of which are not within the control of the distributor. The highest possible of these dangers as well as one that can have a catastrophic influence on the practicality of a distributor, is the failure of a buyer to pay for the items or services it has actually bought. What is trade credit insurance.